Is there a 100% successful way to trade earnings? Probably not. Options can be used to hedge against losses, and also to speculate on price movement once earnings are released.

Is there a 100% successful way to trade earnings? Probably not. Options can be used to hedge against losses, and also to speculate on price movement once earnings are released.

So I begin with a caution: buying options to capture trading earnings is low-probability play. There are many ways to lose, and not many to win. Watch this video and learn how stock investors and options traders can get taken to the cleaners.

The lesson: don't get caught buying options on the day of earnings! There are much better and safer ways to capture profits. So here are some research and strategy tips that might help you avoid costly mistakes.

1. Get a Calendar of upcoming earnings.

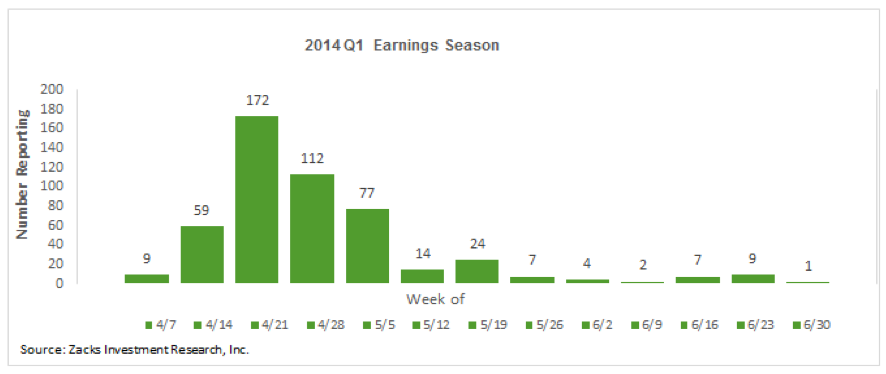

As you see from this chart (for April 2014), earnings announcements come out in a pattern. Traders can expect increased volatility and inflated options prices during these few weeks, resulting in spikes on the $VIX and a couple of good trading opportunities. This pattern repeats four times a year.

Yahoo Finance also offers a table containing the date of earnings for thousands of stocks, sorted by week. Pick the stocks you are interested in and mark your trading calendar.

2. Review the earnings announcements of the stock for the last couple of years and identify patterns in the volume and price. The charts--not the actual earnings numbers--will tell us how traders usually respond to announcements. Here are three things to look for:

- Pre-announcement: Does the stock usually trade up, down, or sideways in the period before the actual announcement? Does volatility increase significantly? Do "open interest," "volume" and the cost of premiums inflate or stay about the same?

- Announcement: As soon as earnings are announced, does the stock move a little or a lot? Does it "gap" up or down? How far on average?

- Post-announcement: How does the stock tend to move in the weeks after? Some see the new price at earnings as a standard, and rarely go below. Others see it an average, and will often trade accordingly.

3. Choose a strategy that takes advantage of the stock's predicted behavior.

Because lots of investors want to speculate on the price moves made by earnings announcements, the price of options at this time balloons. These inflated premiums suggest that prices will in fact move a lot, but there is no way to infallibly predict how far that will be, or in which direction. Traders can make money by 1) the change in stock price and 2) by change in the cost of premiums, or by a combination of 1 and 2.

Favorite strategies include these:

"STRADDLES" and "STRANGLES" If you are confident of a big move, then you can try to win no matter which way the stock goes. Straddles and strangles are market-neutral, meaning they do not care which way prices move at earnings. By managing the legs (Puts and Calls) independently, you can sometimes make money on both.

The Strategy: Buy a Put and a Call near the money a week or more before earnings, and hope you make more than the cost of the premium.

"VOLATILITY CRUSH" Regardless of the amount of earnings, some stocks see options premiums inflate before earnings, and then rapidly deflate in the day or two after. Usually the current month or week gets crushed the most, but it is wise also to look further out and notice how premiums balloon or depress in later months.

Examples of Strategies: Calendar Spread (shorting nearest month and going long further out); Iron Condor (going wide and collecting money from furtherest strikes for the same month).

"REVERSE STRADDLE" If you are confident of a small move, then you can sell premium near the price action and hope you get paid enough.

Strategy: Bull Put Spread. Bear Call Spread, Iron Condor, Butterfly Spread.

3. Just "wait and see".

Many professional traders refuse to pay big premiums when the direction of a stock is uncertain. They wait until earnings are actually announced, and then put on a directional trade.

Strategy: Do not hold options through earnings. If the price then drops, immediately sell Calls and if it goes up, sell Puts.

And finally, the best strategy of all ...

4. Sell inflated premium rather than buy. Play the overall market rather than individual stocks.

As earnings announcements create uncertainty but don't really move the market much, then traders can sell the volatility with reduced risk. Can you see the regular spikes on this year-long VIX chart ? The move from 12 to 18 represents a 50% increase in volatility, and is always sign of a downward correction in price but increase in premium prices. We see this as an opportunity to sell credit spreads at higher prices.

Strategy: Wait until the $VIX is above 18 and sell premium using credit spreads below recent market range. Buy them back when VIX drops below 14.

Tiger says: "Don't follow the crowd! Be a seller when others are buying, and a buyer when others are selling."

----------------------------

Want to know more? Become a HOTTIE and join us at our weekly meetings in Honolulu meetup.com/honolulu-options-traders

Also … LIKE us at Facebook.com/honoluloptionstraders FOLLOW tigertrading.wordpress.com EMAIL GStrading@me.com

[contact-form][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Did you learn anything from this blog?' type='text' required='1'/][contact-field label='Other comments . . .' type='text' required='1'/][/contact-form]