Without a plan, you are left to luck. Maybe you'll be successful, maybe you won't. The HOT Trading System offers a plan that takes advantage of the regularity of the market, while paying attention to changes in volatility. In this blog I will show you the 8 essential steps to developing a profitable trading plan for a $100,000 account.

The HOT method of trading shows how to take advantage by properly managing your portfolio, balancing risk and reward, and creating success by steady repetition of moderate results. Traders should learn and respect the risk-reward ratios of various strategies and not let greed make them too optimistic. The plan will work if you work it!

YOUR TRADE PLAN: TEN STEPS

1. Partition your $100,000 paper account or "farm" into 20 "baskets".

In your PaperTrade account, you will notice on the upper left that you have $100,000 in your account. (If it says $200,000, then you need to select the "margin account" instead of "TOTAL"). Let's call this your "farm".

Now imagine this account is divided into twenty equal segments of $5,000 each.

You will keep space for up to twenty option positions, your "baskets," as they say. Each basket accounts for $5,000 of margin money, making a total of $100k. This partition provides safety through diversity and enables you to accurately compare the performance of each "basket". Your job is to keep the farm full!

Q. What if I anticipate only trading an account of $25,000?

A 1. Practice with $100,000 anyway. When it comes time to deal with real money, we'll make the necessary adjustments. Maybe one day you'll have the $100,000 !

A 2. If you are starting with $5,000 or less, then place high-probability / low-risky trades for six months until your account has doubled. See How to Start Trading with a Smaller Account

2. Scan for the 10 - 20 best candidates.

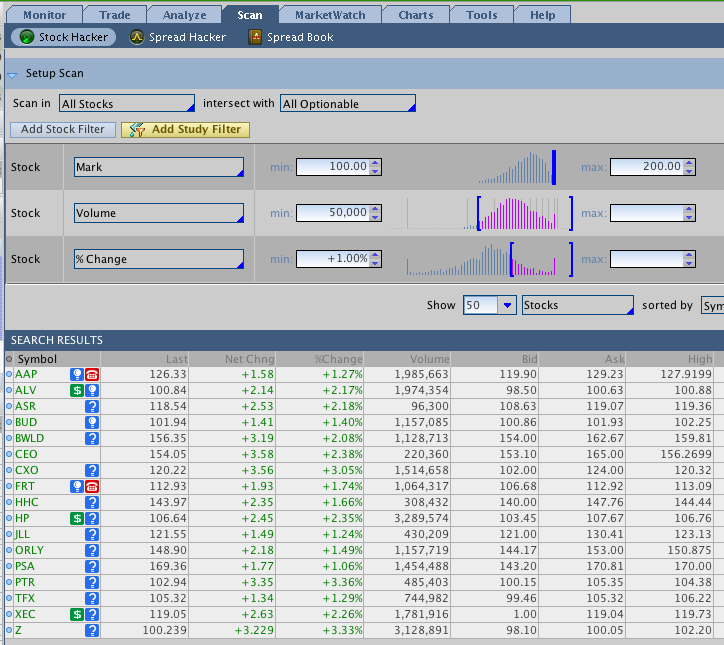

The next step is to find suitable candidates to trade. Use the SCAN function to find optionable stocks. Select "optional stocks" and stocks "above 200" and hit "Scan". Twenty is a good number to start with. [click to enlarge]

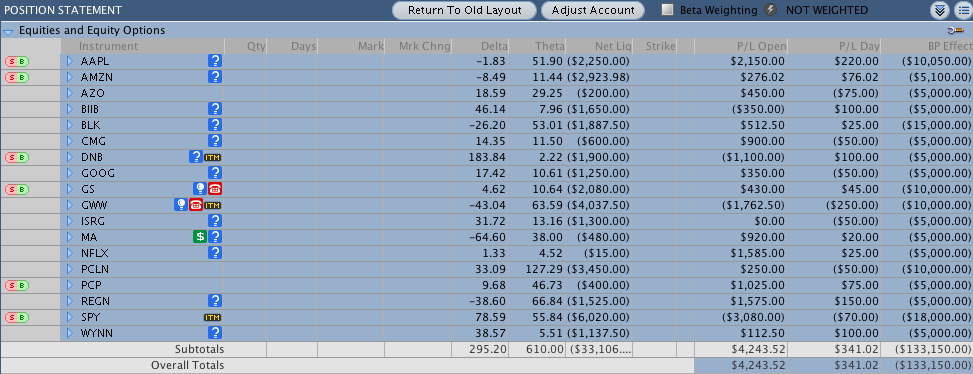

Here is an example of $100,000 portfolio, with underlying stock listed on the left, and the margin amount for each basket on the right column.

[click to enlarge] You will see that most "eggs" require $5,000 of margin capital (or multiples such as $10,000. I have added another egg or two in some cases, in view of the fact that many positions are about to expire.). Successful traders using our method keep their twenty baskets full.We prefer stocks above $200 such as GOOGL, PCLN, AMZN, CMG and other highly successful companies. They generate high amounts of premium and have charts that are easy to read, so are ideal for premium sellers using Credit Spreads. Others such as NEU have good-looking charts, but the volume of trading is so low you might not get filled, so I eliminate them. However, you can use stocks in a range you are comfortable with.

3. For each underlying, choose your strategy and strikes, choose number of contracts needed, and match the amount of margin required to the number of contracts.

If I decide to do a Bull Put Spread on AAPL, I choose to sell a Put below the current price and below recent support. The $5,000 rule enables me to easily calculate the margin on each position. So total margin required on 10 contracts with $5 width between strikes is $5,000 If I choose strikes $5 wide, then I choose 10 contracts. If $2.50 wide, then I will select 20 contracts.

Q: "What if the strikes are $10 apart, instead of $5 ?" A: Then reduce the number of contracts to 5, so total margin required is still $5,000. Your "eggs" will have different credit amounts, but the total margin should be the same.

Q: What about Iron Condors? Do I need to double the margin? A: No. An Iron Condor is

a combination of two credit spreads, both at the same expiration, but there will be only one margin requirement, as the risk to the brokerage company remains the same for two spreads as for one. (Why? Because the expiration price cannot be in two places at the same time.)

a combination of two credit spreads, both at the same expiration, but there will be only one margin requirement, as the risk to the brokerage company remains the same for two spreads as for one. (Why? Because the expiration price cannot be in two places at the same time.)

4. Set GTC close-out prices for your positions.

Once you have fills, you now have "eggs" in your baskets. Ideally, credit spreads will close out at $0.00 at expiration, but that is not always the wisest thing. I usually set a GTC buy-back price at $.05 for the nearest expiration, or .10 per month beyond that, and wait until it fills. If the stock moves strongly, the order can be filled in days or weeks. So my profit would be initial credit minus the $0.05 or more than 95% of my profit potential.

Q: What about Iron Condors? A. Set separate buy-back prices at $0.10 per side for each Puts and Call spread.

Q. Can I roll my positions from one month to the next? A. Yes. Select Rollover to easy to move your positions from this month to next month and pay only one set of commissions. If there is $0.35 of profit left in a trade, but I have to wait a month to realize it, then it may be better to close it out now and reinvest that margin money in the next month. By rolling over from month to month, I keep putting new "eggs" in the same "basket" and recording more profit.

5. The Annual Cycle

"Sell in May and Go Away"?

Is there an annual cycle in stocks and options? Some say yes, others no. I think it is better to play the odds. So, yes, more years than not the market slows down and drops over the Summer months, reaching a low in September. Except for the Presidential election years. It is also easy to pick earnings season as a more volatile period. But what do these patterns have in common? In general, the answer is volume. Moderate volume makes for uptrends, but high and low volume make for downtrends. Each year is different, but keep these general patterns in mind.

5. Prepare for higher volatility in the earnings season months of Jan-Feb, Apr-May, Jul-Aug and October.

Earnings season usually raises the VIX to higher levels, signaling a selling opportunity as premiums expand for both Puts and Calls. As stocks begin to drop, sell Calls above the recent highs. When the VIX begins to fall, buy back those Calls and sell Puts, closing them out when VIX has dropped to low levels.

6. Expect higher prices for retail stocks starting early November, with a peak in the first quarter each year.

During the Christmas retail season, many retail and retail-related stocks (such as FDX) inflate as stock holders await dividends. Disappointment and New Year sale of retail stock then drives prices down again, creating trading opportunities. So we start by selling Put spreads, followed by selling Call spreads in the New Year. In addition, investors tend to by and hold over the last few months of the year, refusing to sell until the new calendar year. This reduces taxable profit in the current year.

7. Spread your trades over several months. There's nothing worse than trying to rescue your account when all your positions into one month. Instead, place perhaps a quarter to a half in weekly trades and current month, another quarter in the upcoming month, then a quarter of them three to six months out, and perhaps a position or two using LEAPS. (These last one should be placed when the VIX is high.)

8. Keep your baskets full. Replace expiring "eggs" with new ones every month or week. Whenever you close a trade, add a new one. Keep the money flowing in, and keep it working for you. That means, for example, replacing earnings season trades as soon as they are closed.

9. Don't close out trades in a losing position (unless it is expiration day). "A fool and his money are soon parted." Its foolish to give back money until all other alternatives have even tried. Instead, try to "repair" the trade using advanced techniques (taught in our Intermediate Class). If you have to give back money, find that money in the market first, so you don't deplete your cash reserves. If you keep giving money back, you will not be profitable!

10. Squeeze more profit out of your positions by using advanced techniques such as selling off

un-needed insurance or moving your strikes.

11. I'm adding one more. Get help from experienced HOT traders if you have questions. Someone is always available to answer questions or help you review your positions. Or join HOT Options and ask your questions online.

Good trading!

Graeme

Copyright © 2014-2106 Honolulu Options Traders |

All rights reserved worldwide.