The E Season comes four times a year--football, hockey, basketball, and grilling. That's once each quarter--in January, April, July and October for all you sports fans.

E Season provides opportunity to make money regardless of the direction of price changes. Any large movement in earnings usually sets the direction for the next quarter.

So, can you get 16 home runs in a season ?

It's time to get out the score board once again and track the stats. I'm talking about stock stats, the ups and downs that happen when companies announce earnings. Can you make money on 16 out of 20 earnings plays?

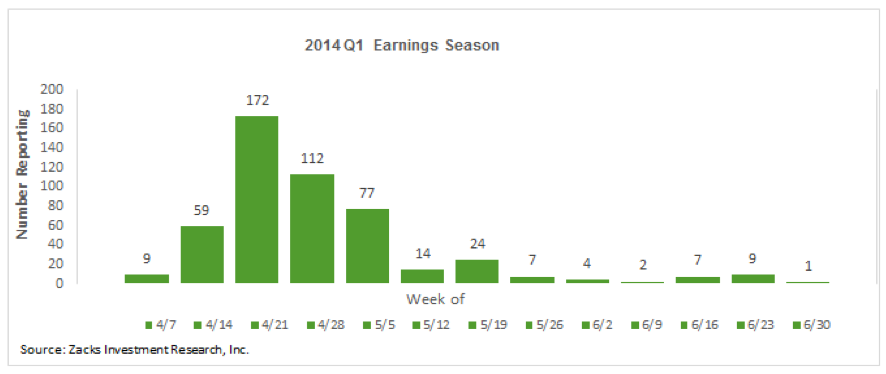

So, lets get started. As you see in this graph, the number of stocks reporting each season forms a peak in the first three weeks, then tails off. Most traders consider each season about 4-6 weeks long. The official start is with Alcoa (AA) usually about a week in, but that is a cheap stock and barely tradable. In our system, we usually finish with AZO the high-flying auto supplies retailer.

the number of stocks reporting each season forms a peak in the first three weeks, then tails off. Most traders consider each season about 4-6 weeks long. The official start is with Alcoa (AA) usually about a week in, but that is a cheap stock and barely tradable. In our system, we usually finish with AZO the high-flying auto supplies retailer.

Do Your Research First

It is important to do some fundamentals and technical analysis before you place earnings trades. You can use thinkorswim's Marketwatch tab or go to the NASDAQ Earnings Calendar to find out any announcements coming up for the next week or go to http://www.nasdaq.com/earnings/earnings-calendar.aspx. In addition, many sites such as Yahoo Finance or Zacks Research http://www.zacks.com and others offer loads of free information.

Three Basic Strategies

There are three safer ways to trade earnings announcements:

- 1. Pre-Earnings Some stocks can be traded nicely by placing a trade a few weeks before earnings and expiring or closing out just before the earnings announcement. Before earnings, traders expect an inflation of premiums of 10%, 20% or even 30%. After the announcement, premiums will return to approximately where they were before, or even lower. Instead of buying options at inflated process, smart traders will sell either before or soon after the announcement, and then buy back later. The difference will be profit.

HOW TO: Place credit spread based on the recent trend of the stock. Make sure the expiration date of the option is BEFORE the earnings announcement. Do not hold the position through earnings.

EXAMPLE If a stock has a tendency to run up before E, then put on a Bull Put Spread at a safe distance below the current price. Use the nearest month or perhaps one more out. Then close out before the actual announcement-- whenever you have large profit, or hold to expiration.

Here is how one trader profits on GOOGL every three months using long Calls.

- 2. Over Earnings "Volatility Crush" ATM options on many stocks tend to inflate strongly, creating a "bubble" which disappears quickly after earnings are announced. By selling the inflated premium, you can collect significant profit.

How does it work? As companies prepare to announce earnings, uncertainty about the direction of the stock causes the prices of options to increase. After the announcement, the uncertainty reduces and the premiums on options rapidly deflates. Here's my analogy: just as the incoming tide raises all boats, large and small, so the increase in volatility tends to inflate prices on most stocks, even on those who are not declaring earnings!

How does it work? As companies prepare to announce earnings, uncertainty about the direction of the stock causes the prices of options to increase. After the announcement, the uncertainty reduces and the premiums on options rapidly deflates. Here's my analogy: just as the incoming tide raises all boats, large and small, so the increase in volatility tends to inflate prices on most stocks, even on those who are not declaring earnings!

When the premiums are inflated, before the earnings are released, sell out-of-the-money Puts and Calls 10%, 20% or even 30% away from the current price. Make sure the strikes you sell are beyond the typical move of the stock after earnings. This is a non-directional trade that works 80-90% opt the time, regardless of the direction of stock price movement. (Always buy a further out Put and Call as protection, and to limit your margin requirement.)

HOW TO: About two weeks before the earnings announcement, enter a trade ticket for an Iron Condor at appropriate strikes at 20-30% above normal premiums. As you see the premiums rise, adjust the asking price and strikes to obtain the maximum available credit. On the very last day or two before the announcement, enter the trade at a fillable price. Once filled, set a buy-back price at 50% of what you sold the credits for. Close the trade when you are satisfied with the profit you have received.

So lets look closer at this pattern.

EXAMPLE Place a WWIC (Wide Wing Iron Condor) at a safe distance from the current price. For me, this is about 150% of the "expected move" on the stock. The secret is to place your strikes beyond both support and resistance. Works best on higher priced stocks (above $200).

HOW TO: Close at 50% of the collected credit. Half the time this will happen within a week or so. If the stock barely moves, you can keep and close it as an Iron Condor. If stock moves a lot, then cancel your Iron Condor closing order and split into Call and Put orders. Then close out the profitable side and replace the closed legs with a new trade. You may need to repair if the price moves too far and breaks your sold strike. See repairs.

Tip: Don't use options that expire this week. You will need time to get out with profit if you get a big earnings surprise!

- 3. Post-Earnings "Slide" using Credit Spreads After earnings are declared, stocks will often gap up or down, signaling a clear direction for the traders. If direction is clear, we sell either a Put or Call credit spread at the pre-announcement close and expect the stock to stay away from our position. Once the stock reaches another turn, or seems to indicate a new trading range, we may then sell the remaining credit spread, resulting in a post-earnings Iron Condor.

HOW TO: As soon as earnings are announced and the stock moves strongly, place a Bull Put Spread or Bear Call Spread at the strike from which the stock jumped. This is most successful when the stock makes a large gap up or down. Expect the stock to stay out-of-the-money for the rest of the quarter--unless major news drives the stock in reverse.

Once the stock stabilizes--usually 4-5 days after the earnings announcement, then place a Credit Spread or Iron Condor with expiration up to but not including the next earnings announcement. Try using the week just before the next Earnings. If you don't know what that is, just go down 12 weeks from the current announcement. Use the 90% probability or better, and consult the charts for medium-term support / resistance to confirm the best location for your sold strikes.

How to Prepare for Earnings Season

So, how can options traders make money on this recurring pattern? Now that we've covered the main strategies, we'll talk about how to prepare and execute. As you will encounter these opportunities four times a year, I recommend that traders follow a system, rather than re-invent the wheel every three months.

Tracking Earnings Dates Each quarter, a schedule of upcoming E announcements appears on thinkorswim and in other locations such as Yahoo Finance.

Finding the Stock: Using our usual scans, pick up 20-30 possibilities and from those I choose 10-20 such as ADS AAPL AZO AMZN BIIB BIDU BLK CF CMG GOOGL GS ISRG MKL NFLX NEU PCLN PCP TSLA UHAL V Y

You can also Set Up a Watch List This Youtube link describes how to set up a watch list in TOS. Make a list of 5-10 stocks and put them into a watch list. You can add new stocks each quarter until you are comfortable with your basket.

Putting on the Trades We will place our bets approximately two days before the actual earnings announcements, and hopefully close the trades within a week after.

Keeping Track

Like all trades, E Season trades should be logged into a spreadsheet. You will be using this list four times a year, so keep your earnings trades where you can compare strategies and results from quarter to quarter. Here is a template you can use in Google Docs or your favorite spreadsheet.

Remember to keep good earnings season records. You will use this same set of stocks over and over again. Your first time, try to get 14- 16/20 successes, then 17, 18 out of 20. It takes about a year of practice, and perhaps a hundred trades, to be consistently good at trading earnings season. Keep an honest record of both the amount of profit and the number of successes and failures in your spreadsheet.

Finally, you can always cruise through E Season and avoid individual stocks by trading the SPY, SPX, RUT and QQQ. You avoid the dangerous volatility of earnings announcements and hedge your bets. By placing perhaps 25% of your funds behind SPY, you still can take advantage of market moves.

Next Quarter . . .

Earnings season will return in three months, and you can do it all again! So keep records and compare each quarter until you become an expert in trading earnings season using Iron Condors.

-----------------------------------------------------------------------------------------------------------------------

Here is your homework for this class. You don't need to trade during market hours to do any of this. Reach out to class members if you need help.

TRADING HOMEWORK

1. As we are currently in E Season, choose 10-20 stocks with upcoming earnings (use the Calendar Tab on TOS to discover them).

2. Choose your strategy for each stock based on recent trends and the strategies listed above.

3. Draw up a spreadsheet like this one

4. Enter orders with 5 or 10 contracts per trades and get them all filled. Then put closing orders in for all trades.

5. Keep going over the next month or so until you have done 10-20 E Season trades.

Now here's a little quiz to keep your brain sharp! See you in class!

All right reserved.

Copyright 2014-2017 Graeme Sharrock and Honolulu Options Traders, LLC.