Drop a stone into a pool and watch the ripple move in concentric rings! A wave moves quickly in all directions, but subsides--and the event is over.

Drop a stone into a pool and watch the ripple move in concentric rings! A wave moves quickly in all directions, but subsides--and the event is over.

In the markets, short-term volatility events occur all the time. International news, company reports, analyst downgrades, financial and economic news or political events can briefly shake the market before disappearing into the blue.

Sometimes we can predict them. Unemployment reports or interest rate announcements are usually scheduled weeks in advance. We know when, but not what, and that uncertainty creates tradable volatility. Learn to trade these brief events and add to your profits!

FOMC Meetings / Interest Rate Announcements

Every month or so, Janet Yellin and the Federal Reserve System comment on the nation's economic condition at 2 pm on a Wednesday (NY time). They also have the power to raise or lower interest rates at this time. Before the announcement is made, premiums on the SPY and other indexes swell as traders and institutions take positions. Option premiums peak on both Puts and Calls because uncertainty is high and institutional managers must hedge their portfolios. Shortly after the report is released, the market reacts and head off in one direction or another--sometimes both within minutes of each other. Premiums drop in value and the ripple has passed.

How to Trade

Just as the ripples from a stone spread from a center, so volatility in prices spreads out from the current price, and affects all prices above and below the current market price. That means both Puts and Call premiums inflate and deflate together. Like the wake from a boat, which spreads in two directions at once, so volatility moves rather evenly over Puts and Calls.

The safest way to trade this kind of event is to sell puts and calls as a pair when the implied volatility is higher (before or at the news release), and then buy them back as a pair when the volatility drops (minutes, hours or perhaps days later). Use strikes a long way from the current price but closer in expiration (this can gives you additional profit from time decay). Selling both is a neutral position regarding price, of course, as we don't expect to make money by guessing price movement. Works best when volatility in the market is already high (VIX over 20).

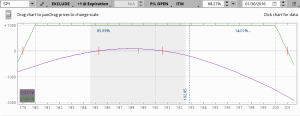

Here is an example 0f a recent set up in SPY when the price was about 190 and VIX about 22. With two days until expiration, we sold the 180 Put and 200 Call, with cheap insurance at 175  (Put) and 205 (Call). The credit was .60 cents. After the FOMC event, we expected the premium to drop, which it did. We were able to buy back for .12 cents, for a gross profit of .48 cents or $480. Some of that was simple time decay but more came from the drop in vega or implied volatility, even though the VIX in the overall market went up.

(Put) and 205 (Call). The credit was .60 cents. After the FOMC event, we expected the premium to drop, which it did. We were able to buy back for .12 cents, for a gross profit of .48 cents or $480. Some of that was simple time decay but more came from the drop in vega or implied volatility, even though the VIX in the overall market went up.

Morning Trades

Another good time to do this is in the first half hour of trading each morning. There is higher uncertainty and premiums tend to be boosted a little, and then flatten out as volume drops off by mid-morning. Use the same principles--sell first and buy back later, using safe strikes and a neutral position. And you can collect money from both Put and Call positions.

To do this place an order to sell a wide-wing iron condor with high volume strikes, but ask for considerably more than the market is offering. The purpose of this is to watch the mark for at least ten minutes before you choose your selling price. You will notice considerable fluctuations--especially in the SPX--and be able to select a better asking price and get some idea of a buy back price. For example, if I notice the mark is fluctuating between 1.60 and 1.20. then place an order at 1.55 or better. When filled place an order to buy back at 1.20 or better, giving you a .35 gross profit. (Commissions must be paid, resulting in a lower net profit.)

I personally don't do this trade very often. It requires me to get up very early in the morning (Hawaii time), which I prefer not to do. But maybe you like those wee hours.

Copyright © 2016 Honolulu Options Traders, LLC.

All rights reserved worldwide.