one and ways of doing things. We live a relaxed life, free from anxiety and pressure. The HOT way of trading options is adapted to life on island, with seasons and tides and prevailing winds—but with a global perspective. Our method of trading will enable you to build a successful financial business without the frenzy of day trading, blearily watching the market for hours every day. Spending only a couple of hours a day, you will be able to manage options positions and generate money for the rest of your life. Just as the ocean and the waves bring the fish to our shores but you use nets, lines and poles to harvest them, so you will learn how to work the times and tools and gather from the abundance of the financial world.

[The photo above of surfers negotiating 40' surf was taken at the 2016 Eddie Akau Surf contest on Oahu'e North Shore by Arnold Kameda, one of our traders.]

one and ways of doing things. We live a relaxed life, free from anxiety and pressure. The HOT way of trading options is adapted to life on island, with seasons and tides and prevailing winds—but with a global perspective. Our method of trading will enable you to build a successful financial business without the frenzy of day trading, blearily watching the market for hours every day. Spending only a couple of hours a day, you will be able to manage options positions and generate money for the rest of your life. Just as the ocean and the waves bring the fish to our shores but you use nets, lines and poles to harvest them, so you will learn how to work the times and tools and gather from the abundance of the financial world.

[The photo above of surfers negotiating 40' surf was taken at the 2016 Eddie Akau Surf contest on Oahu'e North Shore by Arnold Kameda, one of our traders.]

Waves

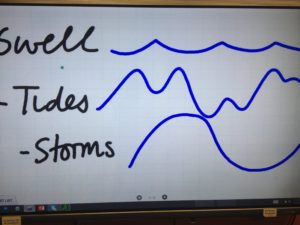

If you watch the ocean for a hour, you'll see waves and changes in the ocean. First of all, everyone is  aware of the large ocean swell that drives energy from distant places and produces surf on our coasts. In addition, the ocean level rises and falls with the diurnal tides. Many factors, including currents, winds and ocean depth make up ridable waves or the surf. Occasionally there will be a storm at sea, or even a hurricane or tsunami--major volatility events that require special skill to negotiate. A surfer knows waves and currents, taking his time to choose and ride with skill to produce a successful ride.

aware of the large ocean swell that drives energy from distant places and produces surf on our coasts. In addition, the ocean level rises and falls with the diurnal tides. Many factors, including currents, winds and ocean depth make up ridable waves or the surf. Occasionally there will be a storm at sea, or even a hurricane or tsunami--major volatility events that require special skill to negotiate. A surfer knows waves and currents, taking his time to choose and ride with skill to produce a successful ride.

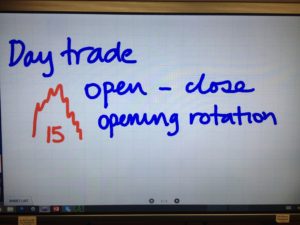

All of this forms a useful analogy to trading as the  negotiation of volatility in the markets. Day traders experience a rhythm like the daily tide. Markets have opening and closing cycles, when market volume and volatility picks up, similar to the daily tides. The ocean swell, with its "sets" of ridable waves, is like the regular weekly, monthly, quarterly and annual option expiration cycles. Then we have earnings season four times a year, times of higher and lower volatility as measured by the VIX. There are times to catch the ride, and times to sit and wait.

negotiation of volatility in the markets. Day traders experience a rhythm like the daily tide. Markets have opening and closing cycles, when market volume and volatility picks up, similar to the daily tides. The ocean swell, with its "sets" of ridable waves, is like the regular weekly, monthly, quarterly and annual option expiration cycles. Then we have earnings season four times a year, times of higher and lower volatility as measured by the VIX. There are times to catch the ride, and times to sit and wait.

Volatility Opportunities

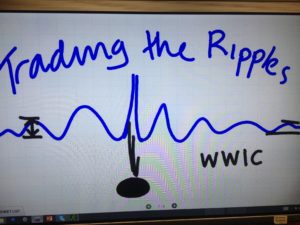

Can surfing help us understand trading events such as earnings season? Traders know that volatility means opportunity to sell options at higher premiums, so they paddle out further to catch the incoming waves. We use wide-wing iron condors to capture profits as premiums dissipate immediately after an earnings announcement. To change the analogy a little, a stone dropped in the middle of a pond will generate ripples which extend outwardly in sequence. This means that even options placed a long way out in strikes or forward in months will still experience a drop in volatility after a major market event. So we sell LEAPS when volatility is very high and buy them back when the VIX drops way down again.

We use wide-wing iron condors to capture profits as premiums dissipate immediately after an earnings announcement. To change the analogy a little, a stone dropped in the middle of a pond will generate ripples which extend outwardly in sequence. This means that even options placed a long way out in strikes or forward in months will still experience a drop in volatility after a major market event. So we sell LEAPS when volatility is very high and buy them back when the VIX drops way down again.

Good trading!

- - - - - - - - - - - - - - - -

The HOT Options Trading System uses “risk-defined,” “high-probability” strategies and emphasizes the careful management of positions in order to ensure profitability. No financial advice or stock recommendations are given or intended, as personal circumstances vary and market conditions are continually changing.