2016 started with a slump that everyone fell into, but ended with a sudden burst of buying. Will 2017 bring stability or more uncertainty for traders?

First of all, a celebration! Our thinkorswim public simulation account started with $100,000 and easily doubled over the year. You can follow the regular postings on our Facebook site and see it was not a fluke but the result of a consistent methodology. In January we will publicly post all our trades for the year for your review.

A quick review of the year shows that investor sentiment is a growing factor in the the markets. The January-February slump was premised on a simple but wrong idea: we are entering a recession. It took another few months for reality to dawn that the predictions of impending economic disaster were not going to happen (again!). But clearly a significant percentage of investors believed the nay-sayers, who continue to sell their fear-mongering newsletters to a gullible public.

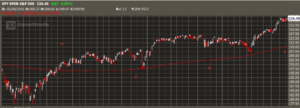

The rejection of pessimism was signalled by a W-formation which transformed an early loss into a steady upward trend for the rest of the year.

The next significant event occurred in late June. The vote to exit Britain from the European Market produced a short but sharp two-day selloff, as investors were shocked by an improbable vote. The US markets sold off but quickly recovered when investors realized that the US would probably benefit from Brexit.

The Federal election dominated the second half of the year. Once it was clear that Donald Trump would be the Republican nominee, the investors put their bets on hold. The market moved sideways for five months, offering many opportunities to sell premium above and below the market. Days before the November 8 election, market makers were expecting a relief rally if Clinton won, but a quick slide if Trump won, as uncertainty about his positions and policies would persist. However, investors delayed buying for several months and simply waited out the election. Trump was the victor, but the market behaved as if Hillary had won! An immediate gap up in the chats gave a strong signal to buy. As options traders we sold Puts, and then sold even more, as the SPY hit new levels and continued until up to the 225 range, an 8% post-election rally. The financial public must be feeling good, but it is only pent-up feeling. Deeds must be done to prove this is all real. Wait and see.

For many decades, election years have been marked with strong sentiment. No one can forget the fear and loathing in the markets of 2008, as the nation slide down on an anti-Bush feeling and Barack Obama rallied the voters, carrying a new generation of hope using social media. Certainly 2016 saw a nation divided by rhetoric and reality. Since the Trump victory, with uncertainty gone, buyers have rotated into various sectors to scoop up bargains: the banks, raw materials, retail, tech, healthcare, and defense. This buying spree is not over yet.

For 2016, the common "sell in May and go away" did not occur, not did we see any significant rise in interest rates. Because the economy remained strong--and the fear-mongerers were so wrong on this--interest rate rises came on and off the table throughout the year, but only when the party was over in December did the Fed take the inevitable step of raising long term rates a quarter point. It seemed so symbolic, and the markets said "So what?"

What will 2017 bring? Will policies or sentiment dictate play? Will a Trump presidency moderate its tone and actually accomplish anything for the American economy? Will tax rates drop, as Trump promises? If so, look for another gap up in the markets, and another opportunity to sell Puts as to Dow settles in for the year a little above 20,000.

Upcoming Educational Opportunities . . .

- What's New in Options Trading? New international markets, new trends, new technologies offer stunning opportunities for traders in the know. Learn how to take advantage of the latest information and make money with stock and currency options. For all levels. Tuesday, January 10, 6:00 pm Free. Details RSVP

- Fundamentals of Options Trading Tuesdays 6:00 pm Jan 17 - March 21. This 10-week class covers the basic principles, strategies and management of stock options, using TDA's thinkorswim platform. Details RSVP

- Advanced Options Trading Tuesdays 7:30 - 9:00 pm. Jan 17 - March 21. For intermediate and experienced traders, a 10-week class on how to trade earnings season, trade repairs, butterflies, low-risk trades, taxes and trading, etc. Details RSVP

- Live Trading 1st and 3rd Friday mornings, 8:00 am - 10:00 am at Manoa Innovation Center. Bring a coffee and danish and join other traders as we discuss and trade the markets using thinkorswim (live Simulated Trading). Usually meets in the Boardroom upstairs. Free. RSVP

Classes held at Manoa Innovation Center, 2800 Woodlawn Drive, Honolulu, HI 96822.

Copyright 2016 Honolulu Options Traders, LLC