Iron Condors are perhaps the most popular options strategy in the book. But often traders get into trouble and lose money with them. The most common reason is in the setup--the spread was not placed wide enough. However, there a second reason: they failed because they did not collect enough credit.

Here is a new strategy that will revolutionize your Iron Condors and make them virtually fail-proof.

So let's go back and take a look at how the Iron Condor works. All informed traders know that there are only three ways to make money in options: either you profit from changes in the stock price, or from major variations in volatility, or from time decay. Iron Condors are the best tool for profits from time decay because they reap income from both sides of the spread, from both puts and calls. The basic theory is that option holders will purchase puts and calls to take advantage of price changes in the underlying, and so sellers of options provide these options for a cost. However, at expiration, the price cannot be in two places at once, so the seller of options on one side always wins. The time value or theta of the purchased options always diminishes over time, so once again the seller wins.

So how does an Iron Condor lose money? There is only basic way to lose: the price of the underlying stock moves too far (out of recent range), causing the purchase price of the option to exceed the original selling price. Then the option writer (seller) must buy it back for a loss. Answers to this problem are 1) only trade Iron Condors on stocks that don't move very much (but major news can disrupt that plan), 2) place your strikes far enough away that they won't be broken (no guarantee is possible, however), and 3) get enough credit on the spread to cover any potential losses (not likely on more stable stocks).

So what is the solution? How do you plan and place an Iron Condor so that it is virtually guaranteed to not lose money? Here is the most successful plan I know.

- Choose underlying stocks with a Beta of about 1 - 1.5, with weekly options, and moderate to high volume in the options. These will generally track with the overall market, generating enough premium to make sellers happy.

- Choose stocks which have a habit of moving strongly in one direction after an earnings announcement. Examples are AMZN, PCLN, GOOG, GOOL, NFLX, AZO

- Leg into the Iron Condor by placing the first leg immediately after an earnings announcement. If the stocks gaps down, then sell Calls at or close to the jumping off point. Do not place the second legs yet. Wait until you have some profit in the first leg.

- Place the second leg a few days later, when the stock seems to be stabilized. Look for lower support (in the case of Puts) and place it there. It should be about equally distant from the initial jumping point. This will create a balanced spread. You will also take advantage of decreasing volatility as the size of candlesticks shortens and the price levels off. At that point, the big move in the stock is over and you should have rapid premium decay as volatility drops further and time moves on.

- Sell at about 60 days away, and not more than the next earnings announcement. To do this, select a weekly option about 60 days away. You should collect a total of $3 to $5 on $10-wide strikes. Test the available credit by moving the expiration from week to week until you are comfortable with the amount of credit. For example, some traders say it is better to collect $3.30 for an expiration six weeks away than $4.20 for 10 weeks away. Others say you should sell right up to the week before the next expiration, and collect as much as possible before then, because time decay will give you enough profit to close out long before the spread expires. I prefer the second simply because more credit means less risk. These condors usually close out weeks before expiration, so the actual date of expiration is moot.

- Place closing order on your Puts and Calls separately, at .10 cents per month. One side will certainly close before the other. If it is November now, and I am trading January, then my closing order will be for .20 cents.

But, even with this excellent strategy of legging-in over time, there is risk. How do you turn the Iron Condor into a no-lose trade?

Calculating Risk with Credit Spreads

Lets start with the risk itself. The risk comes from not collecting enough premium. If strikes are $10 wide, then anything less than $10 collected is my risk. Here is the normal risk calculator for any credit spread such as Bull Put Spread![]() With this simple

With this simple formula, you can calculate the risk of any credit spread. In each case, the simple calculation is exactly the same, whether you are using Puts or Calls. That is why your brokerage firm will set aside "margin" to be used to pay for any possible loss in the trade. When the trade is nobler, that money is liberated to the account and you can go and place another trade.Here is a graph of a GOOGL Bull Put Spread at 1000/990 for a credit of $3.40. The risk is therefore $6.60, as we see from the calculation.

formula, you can calculate the risk of any credit spread. In each case, the simple calculation is exactly the same, whether you are using Puts or Calls. That is why your brokerage firm will set aside "margin" to be used to pay for any possible loss in the trade. When the trade is nobler, that money is liberated to the account and you can go and place another trade.Here is a graph of a GOOGL Bull Put Spread at 1000/990 for a credit of $3.40. The risk is therefore $6.60, as we see from the calculation.

Calculating Risk with Iron Condor Spreads

An Iron Condor is simply the combination of a Bull Put Spread and a Bear Call spread. The Iron Condor usually pulls in twice as much credit as a single credit spread. Because the price at expiration cannot be in two places at once, then margin requirements are calculated for one side only, but the credits are added together. This is an opportunity to create spreads with less total risk than standard credit spreads.

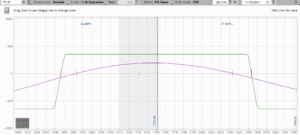

Here is the formula:![]() For example, e.g. in the example here for PCLN, a 1650/1640 Bull Put Spread spread [1650-1640] - [credit of 2.20 ] is added to a 1750/1760 Bear Call Spread [1750/1760] - [credit of 1.60] for a total credit of 3.80. That means the risk is $6.20.

For example, e.g. in the example here for PCLN, a 1650/1640 Bull Put Spread spread [1650-1640] - [credit of 2.20 ] is added to a 1750/1760 Bear Call Spread [1750/1760] - [credit of 1.60] for a total credit of 3.80. That means the risk is $6.20.

Designing No-Risk Iron Condors

Now that you know how risk is calculated, one thing should be obvious: the more credit you collect, the less risk in the trade. It is virtually impossible to collect 100% of the available credit at once, but it can happen in several steps.

- Create a wide-wing iron condor following the steps above, until the Iron Condor is complete. A total of credit of $5 total for $10-wide strikes is deal. It means you've reduced your risk in half

- Place orders to close each side at .10 per month. One side will close before the other.

- Roll the strikes up on the closable side, and collect at least $2.50 credit. Place orders to close that side again at .10 per month. Now you will have total credits of approximately $7.50.

- At some point, after you done this two or three times, the price will hit the short strike on one side. Move up the other strike and create an Iron Fly. That means the Put and Call share a common short strike. You should be able to collect another credit for $4-5 more for this move. Close each side for .10 cents. Make sure the entire spread is closed before expiration to avoid being assigned stock.

- At this point, often in the final two weeks off the spread's life, you have zero risk left. Add up your credits and see where you are. So yes, it is possible to collect $11, 12 or 15 on a $10 wide strike--if you take it step by step.

That's the first way to create a no-lose Iron Condor!

Stay tuned for the second way and third ways to create these exciting spreads.

Copyright 2018. Honolulu Options Traders, LLC All rights Reserved.