Are you ready to go naked--or almost naked?

We now explore the risky business of naked trading, how to assess your risk and make wise choices. In this post you will learn how to go naked--or half-naked--and make profits in your account.

The Privilege and Dangers of Being Naked

Naked trading is very profitable but also the most risky type of trading. You could literally lose everything in your account. Unlike most other trades, these are NOT RISK-DEFINED. Honolulu Options Traders, LLC does not recommend this kind of trading except for special low-risk situations and for limited periods.

So why do traders go naked? I think the main reason to avoid the cost of insurance. There are two ways to pay for the risk on any trade: 1) you put up margin money (your brokerage firm will set the required amount), 2) you buy insurance to limit your risk. For insurance sellers, this is a cost which reduces the potential profit on a trade. So some traders simply go naked to avoid the cost. However, there are some very important guidelines that must be followed.

Naked trades should be careful monitored and closed whenever your loss meets a pre-defined limit. Your brokerage company also monitors your trades and may close our your positions without recourse if they believe you are not handling the account responsibly. They may also close the account and bill you for any loss in excess of your capital. Do not let this happen!

To place short or naked trades, you will need Level Three trading privileges on your TOS trading account. Your brokerage company will review your trading record and usually grant it. You may need to explain that it is needed for your class.

You need to know that IRAs and other restricted funds do not allow naked trading, as it is considered too risky. If you hoped to use near-naked positions in your retirement funds, you should instead consider other options below.

(For more, see our post on Risk Management.)

Puts--Long & Short

Let's start with a review: what is a Put? a right to sell stock at a fixed price by a specific date in the future. Puts involve the right to sell things, and who wouldn't want that?

So if I am LONG or own a Put, I can sell my stock at any time at a selected price no matter how far down the market goes. Investors use Puts to protect their portfolio from loss when prices drop. OTOH, then I am SHORT or write/sell a Put, I am accepting the obligation to receive stock at a specific price at any time if the Put owner should decide to "put" me the stock".

So, first, let's review what we know about Covered Calls and Puts,

Review: Covered Calls & Puts

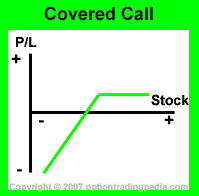

From the earlier classes on strategies, you will remember that Covered calls involved adding a short Call to a stock position or to a long Call position--usually for the purpose of generating monthly income.

From the earlier classes on strategies, you will remember that Covered calls involved adding a short Call to a stock position or to a long Call position--usually for the purpose of generating monthly income.

If the Call expires OTM, then you simply keep the cash. If the Call expires ITM, then the stock will be taken from you at the exercise price. Properly managed, in a gently uptrending market, Covered Calls can generate a few % each month with safety.

Just as you write covered calls, you can write covered Puts. Just add a short Put position to a short s tock position, or combine a Put with a short Put. This used to collect income whenever stock prices are dropping a little.

tock position, or combine a Put with a short Put. This used to collect income whenever stock prices are dropping a little.

So covered Puts and Calls are tools used to generate income, as they are very limited in their capacity for long term profit. When one expires, you simply sell the next month and do it all over again. If you can put together a portfolio of Covered Calls in established blue chip stocks, you will usually do well over time, generating perhaps 2-4% per month income.

Married Puts

When you buy stock and a Put at the same time, they are considered "married". If the stock goes down, then the Put protects. If the stock goes up, the whole position makes money, although not as much as if there was no Put. You can't have it both ways, or can you? Its protection at a price.

When you buy stock and a Put at the same time, they are considered "married". If the stock goes down, then the Put protects. If the stock goes up, the whole position makes money, although not as much as if there was no Put. You can't have it both ways, or can you? Its protection at a price.

Of course there are Married Calls as well, but the only people who want these are hoping for the market to go down. They short stock, and then buy a Call in case it goes up.

Writing Puts

We finally get to the naked truth! As OTM Puts and Calls are intrinsically worthless--they only contain time value or theta--then we like to sell them and collect money. If we sell them naked, meaning without any protection at all, then we are exposed to maximum risk. Hopefully the premium we collect is worth the risk!

1. Selling Puts for income

In an uptrending market, we can sell Puts and generate income each month. (This is similar to the idea of selling Covered Calls for income on stock.) Sell and hope the price goes up.

EXAMPLE: IBM is at 160 and about to declare earnings. If I sell the 160 Put, I can collect  $3.40 in premium. Or I can sell the 157.50 Put for $1.10. Or the 155 for $.45. The further away from the current stock price I sell, the less I collect. The price needs to be only slightly above 160 at expiration to achieve maximum profit.

$3.40 in premium. Or I can sell the 157.50 Put for $1.10. Or the 155 for $.45. The further away from the current stock price I sell, the less I collect. The price needs to be only slightly above 160 at expiration to achieve maximum profit.

Add a lower strike for insurance, or to limit margin requirements. If you want to have the full effect of a naked put, but still prefer to limit margin requirements, then find a cheap lower strike such as the 140 Put and buy it for $.15. Remember you can still be put stock at any time if you write a Put. In that case, you still keep all the premium you collected. But you will have to intelligently manage the newly acquired stock!

2. Buying Stock at a Discount

If you want to actually buy stock at a discount, then sell or write a Put to ensure you get a better price than the current market, using a "cash-covered put". Your brokerage firm will ask you to provide enough cash to pay for the stock. In a margin account, that would be usually 50% of the total cost of the stock.

EXAMPLE: AMZN is at $325 but you would be willing to buy it at $315. Sell the 320 Put and collect $5.00. If the stock closes under $320 at expiration, then you will be put the stock at 320, but your effective price is $315. You will need to come up with $157.50 per share in order to purchase on margin. (A better use of you money, with more safety, would be buy a deep-ITM Call option, which acts exactly like the stock.)

EXAMPLE: TIF is at $80 but you are concerned the stock will rise in price before your Christmas bonus arrives. Lock in today's price by selling a deep-ITM put to expire in January. This will also guarantee you can buy the stock in January at an effective price no higher than today's price. Your brokerage account may require you to put up some cash, in case TIF stock price drops. Instead of putting up the cash, you can always buy another Put close the current price, which prevents loss in case of a drop in TIF's stock price.

3. Selling Deep ITM Puts and Calls

A directional strategy we often use entails sell high-Delta Puts in a Rising Market, and buying them back when the stock is at higher price levels. Similarly, we can sell Calls, if we expect stock prices to drop, and close them at a lower price or let them expire.

Neutrally Naked

In addition to writing or Selling Puts for the reasons stated above, traders can sell neutral positions made up of both Puts and Calls. In most cases, we are collecting premium known also as theta. There is lots of theta sitting out there in the option chain. Using the Straddle and Strangle strategy tools, you can sell strikes, both Puts and Calls,with probability of 80 or even 90 % OTM at expiration.A favorite in the HOT community is to sell Straddles (short term), Strangles (medium term) and LEAPS (long term). These are all neutral strategies, as traders expect the price to stay within a defined range.

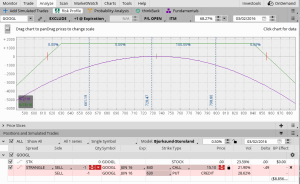

Here is an example from TSLA. Note that the strikes are about $70 wide from current price of $270, with about 81% probability of expiring OTM.

It is very likely that you will not hold this short position until expiration but will close it out when you have nice profit.

- Choose strikes which are at least expected to be at least 80% OTM as expiration .

- Enter you orders carefully to assure maximum profit (e.g. as a short Strangle)

- Close both legs together when you have a nice profit, but long before the price gets near your sold strikes.

EXAMPLE: Volatility (via the $VIX) is over 20 and you decide it is time to sell some premium on AAPL which is priced at about 120. You decide to sell the $80 Put ($40 away) and the $160 Call (also $40 away) using LEAPS. You can place these two trades at the same time (use the short Strangle strategy):

- Sell -1 AAPL Jan 16 80 Put for $ 4.20 [click to enlarge]

- Sell -1 AAPL Jan 16 160 Call for $ 4.80. (You can't see the other green line this on the chart because it doesn't go high enough.

TDA calculates and asks for $2,200 margin money. There is no real danger as long as the price stays close to the middle of the 80-160 range. If the price moves above $160 or below $80, the brokerage firm may ask for more margin money. CLOSE OUT each wing separately or together whenever a total of 20% - 50% of your expected profit occurs. This may take a short or long time, depending on price movement and volatility.

Going Semi-Naked

If the margin requirements are too large for you, consider one of these two techniques to add some safety and reduce the margin needed.

Convert to Wide Wing Iron Condor. Simply add wide insurance strikes on one or both sides. You can often get some insurance by paying as under $1 for an OTM strike. Where you place your strikes, and how much risk you want to take on each trade, is up to you. First, choose your selling strikes and insurance strikes, then adjust the number of contracts to minimize your potential loss.

Use Ratio Spreads. Instead of buying full insurance on each side, place the whole trade using ratio spreads. Start with Ratio Spread or Condor or Iron Condor from the Spread menu then adjust to Custom if necessary . Choose your strikes and numbers of contracts after reviewing them in the Analyze Tab.

EXAMPLE: Here are three GOOGL charts using a $100 wide spread a Naked Straddle, regular Iron Condor, 2/1 Ratio spread.

Compare the Credit amount for the three charts, then the Buying Power effect, and calculate the ROI for each position at expiration. Which would you prefer to trade?

HOMEWORK in your PaperMoney account:

1. Create a Covered Call using a stock under $100. Place a closing order that almost certainly will generate profit in the next two months.

2. Create a Naked Put using a stock under $50. How much margin is needed? Is there some way to go half-naked and limit your margin?

3. Choose a sideways moving stock and sell a Strangle a LONG way from current price (consider up to 50%). How much did you generate? Now create an Iron Condor version, and then a Ratio Condor version. You may need to use slightly different strikes to avoid confusion.

Copyright © 2016 Honolulu Options Traders, LLC.

All rights reserved worldwide.