Looking forward to the last day of your life?

Looking forward to the last day of your life?

Not likely. But looking forward to expiration day is part of the joy for options traders who have sold options. Options have a birth and a death, starting with their mysterious origins in the vast internet, and ending with the notice of expiration on the 3rd Friday of each  month (or any Friday). Their life span may be a week, a month, a quarter, or a year or more (LEAPS). At their last moment, the time value runs out and they "expire". ITM options are worth exactly their intrinsic value, and OTM options are worth nothing at all. Its all or nothing!

month (or any Friday). Their life span may be a week, a month, a quarter, or a year or more (LEAPS). At their last moment, the time value runs out and they "expire". ITM options are worth exactly their intrinsic value, and OTM options are worth nothing at all. Its all or nothing!

What happens during expiration week?

- weeklies and monthlies expire

- premiums go to zero

- prices go to strikes

- volatility drops

- stock is assigned

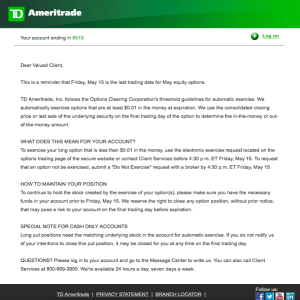

You could also get an e-notice like this:

In case you've forgotten, the brokerage company wants to remind you of their settlement policies. And you don't want any surprises--like 1,000 shares of PCLN stock suddenly showing upon your account and a bill for over a million dollars! So read and take sure you understand the fine print in these notices.

What are the opportunities?

- Rollover to the new month, to reduce your risk and save on commissions. Adjust your strikes and expiration dates and do it again and again. Once closed, the old month is "in the bag".

- Generate quick income each week or month using ITM credit spreads short straddles, strangles, and butterflies. The instruments you use should take advantage of premium decay at the next expiration date. Placing them a few days before increases your chances of selecting the appropriate strikes.

- Go Long! “Large-cap stocks with actively traded options tend to have substantially higher average weekly returns during these weeks. A simple market timing strategy could be therefore constructed -> hold the largest stocks during the option-expiration weeks and stay in cash during rest of the year.” QUANTPEDIA http://quantpedia.com/screener/details/102

- Deep ITM options get very cheap, which means you can get great leverage if you guess right.

- Go Long! “Large-cap stocks with actively traded options tend to have substantially higher average weekly returns during these weeks. A simple market timing strategy could be therefore constructed -> hold the largest stocks during the option-expiration weeks and stay in cash during rest of the year.” QUANTPEDIA http://quantpedia.com/screener/details/102

- Butterflies

What are the Dangers of Expiration Week?

1. Stock Removal

If you sold a Call which remains in-the-money, the new option holder may at any time exercise their Call and take stock from you. While most traders do not wish to own stock, option owners can at any time elect to exercise their option and request that the option seller deliver stock to them. You will know because you are short shares in your account.

EXAMPLE: You sell an AAPL 125 Call for $2.10. The price rises to $131 and the option holder, decides he wants those AAPL shares for $125. He elects to exercise his option, and you find -500 shares in your account. You must close the position or deliver the shares.

2. Stock Put to You

If you sold a Put which remains in the ITM, the option holder may require you to BUY or take stock into your account.

EXAMPLE: You sell an AMZN 360 Put for $11. At expiration, the stock is "put" to you at $360. You now owe your brokerage firm $360 X 100 = $36,000. Your actual or net cost for the stock is $34,900, a saving of $1,100 on the purchase.

EXAMPLE: You want to own NFLX, now at $375, before it rises even higher. You sell a NFLX 400 Put for $27.50, almost guaranteeing purchase price of $400, and receive a credit for $27.50. You effective purchase price is now $372.50.

3. Margin Calls.

If you have stock taken from you, because someone exercises an option which you sold them, then your brokerage will take that stock from your account (if you have it). This reduction could affect the amount of margin power your account has. As a result, you might get a "margin call"asking for cash. If you're account is leveraged, this is a troublesome event.

EXAMPLE: You are trading options in a $100,000 stock account which has $150,000 trading power (margin = 150% of stock value.) $30,000 of stock is taken out of your account in exchange for $30,000 in cash. Now your trading power on margin is reduced to $30,00 plus $70,000 X 150%, or a total of $135,000. If you were extended to $145, 000 on margin, you will get a Margin Call for $10,000.

HINT: Use separate accounts for stock and options trading. Do not leverage your options account but trade cash-on-cash only.

4. Covered Calls

If you own stock and have sold a Call for income, then you will lose your stock if the Call expires ITM.

EXAMPLE: Margaret owns AMZN and sells Calls to bring in nice income each month. She sold the 320 Call for $8.00 and then went on vacation. While gone, the option expired when the price was at $324.66. On Saturday her broker called, asking for 100 shares of AMZN which he took from her account. Next month she needed a few hundred dollars income but don't have any more Covered Calls to generate money and had to dip into her savings.

HINT: If you re trading Calls for income, then ROLL your Call to the next month on expiration day or before to avoid problems.

5. The Bitter End

Marty loves to watch the screen. He bought a Put and a Call (a Strangle), hoping his stock would move during expiration week. It didn't. Now he is sitting with a double-whammy--he lost money on both Put and Call. But he watched until the very end as the stock settled between his strikes. He had lost all his premium and closed trading with a bad feeling that went all weekend long.

HINT: It is better to sell out early in the week with a smaller profit. If you double your investment, be happy. Expiration Friday is for the professionals to balance their accounts. Instead, roll out early with profit and look ahead to the next time u will trade with profit.

6. Automatic Exercise

All brokerages have a policy which says they will automatically exercise any option which is one cent or more in the money at expiration. This applies to all Calls and all Puts. However, this cannot occur before expiration. If you have a vertical spread, and one option is ITM and the other is not, you may be exercised, maybe not. If both are ITM, then you can still be assigned stock, but your brokerage may choose to immediately sell your position to avoid the risk of further loss.

EXAMPLE: Mel bought an IBM 180 Call for $2.50. At expiration, IBM is at $180.90, and Mel's option is automatically exercised. Mel's account receives 100 shares of IBM and a bill for $18,000. Effective cost is 18,250, as Mel had to pay $2.50 for the option as well. But Mel could have sold a 180 Put to pay for the Call option, for say $2.60. So his effective price on the stock purchase would be only $17,900.

If you don't want to exercise, then simply call your broker and waive your right to exercise. This saves possible risk to the stock value over the weekend, as the stock could drop in value before you've even paid for it. Its sometimes just not worth it!

HINT: If you want to save money when you buy a stock, DONT' BUY a Call option. Instead SELL a Put! Either you will collect a small profit or you get the stock at a discount. Your choice.

==================================================================

HOMEWORK:

1. Select from your current position 10 trades which will expire THIS week. If you don't have 10, then initiate positions such as spreads, short straddles or long strangles. Manage them to avoid assignment or automatic exercise wherever possible.

2. If you have assignments such as 100 shares or -500 shares, then close them out as soon possible. How did they occur?

3. Keep a record of all expiring trades and write notes on the outcomes. Tally up your profitability over the ten trades. Do this many times until you are comfortable trading expiration week.

Copyright © 2014-2016 Honolulu Options Traders, LLC.

All rights reserved worldwide.