Clement Stone, the famous Chicago billionaire businessman, famously said there's two ways to financial success: OPE and OPM. Other People's Experience can be found by reading books, joining seminars and classes, and by finding an expert in your chosen field. Other People's Money is the power of leverage by borrowing and investing that money for limited periods, then returning the money when you are profitable. You keep the profits.

Clement Stone, the famous Chicago billionaire businessman, famously said there's two ways to financial success: OPE and OPM. Other People's Experience can be found by reading books, joining seminars and classes, and by finding an expert in your chosen field. Other People's Money is the power of leverage by borrowing and investing that money for limited periods, then returning the money when you are profitable. You keep the profits.

Today I will show you how we recently generated huge profits on AAPL using OPM. I taught this in our live trading class at Honolulu Options Traders on Friday Feb 7 and now it is less than a week later. First of all, Apple Computers recently announced they were going to buy back $12 billion of their stock. That's got to be bullish for the stock, which had unexpectedly been hit with a down draft when earnings were announced on January. You can see the big gap in the chart around Jan 28. The company was buying in the $500-510 range, so we knew that was a floor we could depend on. I saw a $50 upside in AAPL and recommended that traders

1) Sell the $500 Put (with a $495 or 490 long Put for protection) and wait until AAPL hits around $515 to put on another spread. A few days later, AAPL tested the $495 low and started moving up.

See the gap? (Click to enlarge)

We predicted that AAPL would quickly fill the gap from 515 to 550. Since then it has been a straight line accumulation of stock, driving up to $543. We predict it will continue to $550 possibly $560 before meeting resistance, completely closing the gap. But what strategy did we use?

2) Sell Deep ITM Puts using OPM. You mean, just like Clem Stone suggested? Yes. Instead of buying Calls, we sold deep ITM Puts with protective Put at 510. The order was

Sell 10 AAPL March 560 Put -$56

Buy 10 AAPL March 510 Put + 18

CREDIT of -$38

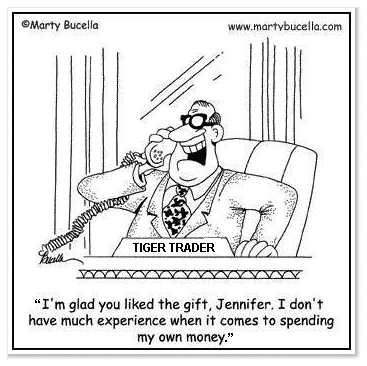

That $56,000 credit is OPM--and we don't even have to pay interest on it! That's $38,000 potential profit for a risk of $12,000. (This "risk-defined strategy" could also be done for a risk of only $1,200 by selling one contract instead of ten. ) This strategy has no name that I know of, except its a kind of deep ITM Bull Put Spread. I'm calling it my Tiger Put Spread!

HOW TO CLOSE THE TRADE-- Buy back half your position when AAPL hits $550. Hold the other half until expiration or AAPL hits 570, then close it all out for maximum profit.

UPDATE 2-19-2014 5:00 pm

As we thought, AAPL climbed to 550 (the upper green line) and sold off quickly, as traders took profit from the run up from 515. Take a look at this chart--now ain't that pretty !!!

We closed all our AAPL positions when AAPL hit 549.50--two Bull Put Spreads--for a huge profit. It was too tempting to leave anything on the table. A great week trading!

TIGER Says: "Collecting cash is the best way to avoid losing money!"