Are you trading options on the wrong stocks? The fact that a stock is in your 401k, or belonged to your grandfather, or is a well-known brand name, is no reason to trade options on it. As options traders, we are seeking to make the most money with defined and manageable risk. That means we need to find the best candidates and then choose the best options available. We ignore "hot tips" and other useless advice and instead look for the money! This blog will help you find those candidates and enter orders which will build the cash in your account.

Are you trading options on the wrong stocks? The fact that a stock is in your 401k, or belonged to your grandfather, or is a well-known brand name, is no reason to trade options on it. As options traders, we are seeking to make the most money with defined and manageable risk. That means we need to find the best candidates and then choose the best options available. We ignore "hot tips" and other useless advice and instead look for the money! This blog will help you find those candidates and enter orders which will build the cash in your account.

STEP ONE: Set your scans to generate 15-20 good candidates.

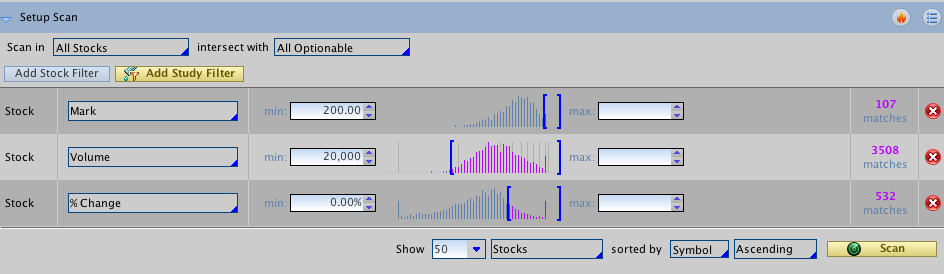

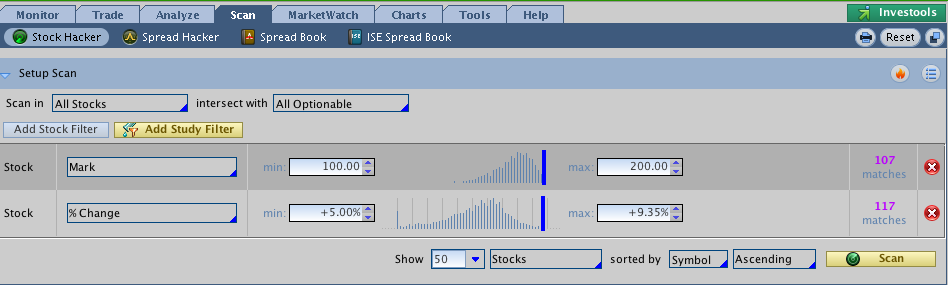

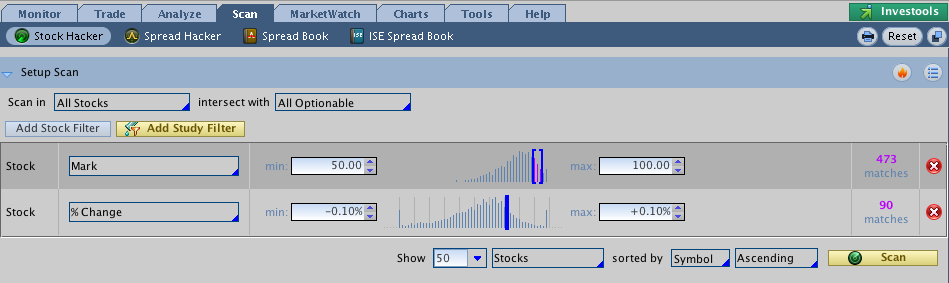

In our class, we choose candidates from stocks in three price ranges: $200+, $100-200, $50-100. We don't care what industry they are in. We do care that they have moderate volatility, moderate to high premiums, and are easy to manage, so we start with a wide net. The numbers at the right hand side of the scan will tell you how many tradable stocks are available under this criteria.

Set your scan as follows to trade options on stock over $200 per share.

Set your scan this way to trade options on stock between $100-200 per share.

Set your scan like this to trade options on stocks between $50-100.

In the $200+ range, there may be less than 20 available. The range $100-200 may have over 100 candidates. I prefer to look at them all, and qualify them based on direction, range, implied volatility, and premium available. In the lowest range $50--100, there are over 1000 stocks, so I definitely set "Change" above +2.5% and below -2.5% to catch the ones which are moving the most, as they generate the most premium. There's a lot to choose from so I am guaranteed diversity.

You can also scan for stocks which move a certain percentage, or which offer a certain amount of earnings per share, or which are based on higher volume. But as we are looking for high beta stocks, then the scan which tells us how much underlying stock move are the most useful. Set your scan in each price range for 2.5+% and then -2.5+% to find stocks that have moved2.5% percent up or down in the last day or so.

Next, we throw out the bad eggs. That means that stocks whose options strikes are too far apart, or with not enough volume, or with highly erratic charts will be dropped from consideration. Pharmaceutical and medical equipment stocks such as CPT or ISRG are difficult to trade so so avoid them if you don't know the industry well.

STEP TWO: Review the charts and choose the strategy.

Go for the money! We consider that stocks with the highest amount of premium to be the best candidates. The criteria we use are *high price, *high implied volatility, * and *chart pattern. Just like with friends, we want our stocks to be exciting and energetic, but not so impulsive that they endanger us! Our favorite chart pattern is "slightly up and sideways" as these can easily be put into Iron Condors.

For safety reasons, we avoid stocks whose strikes are too wide to be of much use. Ideally, we want $5 or $2.50 strikes for higher priced stocks (over $200) and $5, $2.50 or $1 strikes for those priced $100 and $200, and definitely $1 for stocks under $100.

More stocks to avoid: Pharmaceutical and medical equipment stocks (such as ICPT, ISRG) are best avoided using credit strategies because their chart "personality" is erratic and unpredictable.

Once we have a good number of candidates, it is time to sift them and reject those that aren't very tradable and we end up with stocks which look "tradable". That's an ambiguous phrase, of course. We are thinking of charts which offer clear and defined trends such as steady growth over the last year, long-term sideways channel, or a bottoming and topping action. If we can fit a strategy such as covered calls or credit spreads to the chart, then we have good candidates.

CHART TYPE RECOMMENDED STRATEGY

Steady upward Bull Put Spreads, Covered Calls

Steady downward Bear Call Spreads, Covered Puts

Sideways Iron Condor, Swing Trades

Seasonal Cycles Calendar Spreads, Swing Trades

THE EXAMPLE OF GOLDMAN SACHS (GS)

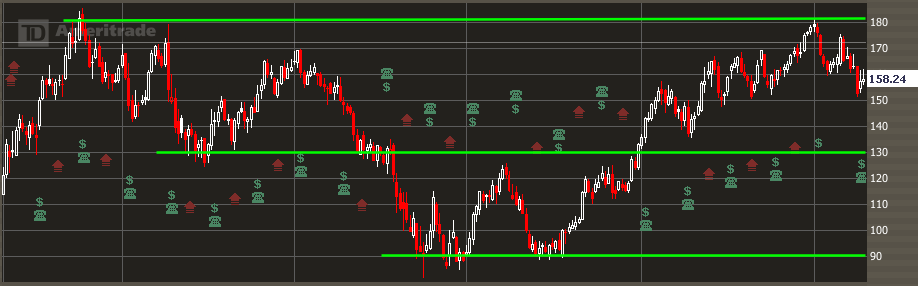

Here's Goldman Sacks (GS), chosen from the $100-200 range, showing us a beautiful, tradable channel...

Now here's a 5-year look at GS, giving the "bigger picture". Several years ago, it peaked at around 180 and then retraced half of its value, before testing that level and heading back to 180 again. Since then it has been slowly heading down-to-sideways. I've put in another green line around 130 which seems to be a pivot point. As long as the economy is in an expansion phase, we expect GS to remain above that line.

In late 2013, we legged into an Iron Condor using the 130 Put and 180 Call strikes. As long as the stock stays in that range, we are profitable.

So choose up to 20 potential candidates such as GS and then move to step 3.

STEP THREE: Finding the Money

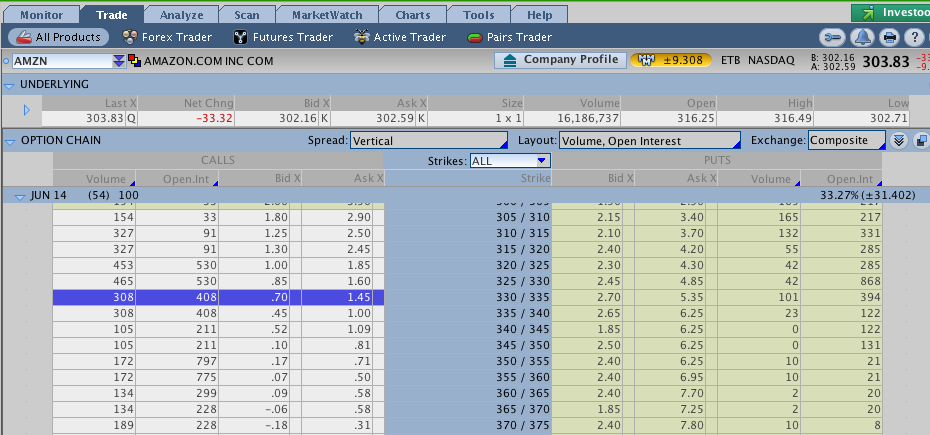

Next, we need to find out how much money we can collect using credit spreads. To do this, open the TRADE tab and set the Spread at Vertical. Then find the strike you want to use. (For Iron Condors you will need to do this twice, once for Puts, once for Calls.) Here's AMZN, for which we have decided to put on a Bear Call Spread at the recent highs, before the earnings announcement.

We've chosen the Jun 330/335 Call Spread as we expect to see AMZN below 330 for quite a while.

STEP FOUR: Putting in the Order

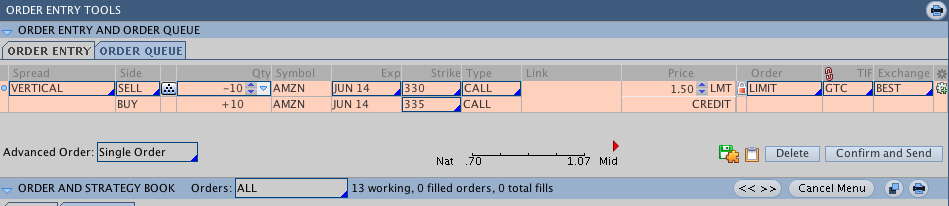

Here's the trade ticket, asking for a Credit of $1.50, just beyond the "natural" of current asking price.

And here is the fill ticket, two days later, which put $1,500 into our pocket. So potential profit is $1,500 and potential loss is $3,500. When the charts tell us that AMZN is turning up again, then we may add a Bull Put Spread for a similar amount of credit. $1.50 + 1.50 = 3.0 credit = $3,000 profit. No extra margin us needed to add the second position (making an Iron Condor). The potential profit on this double trade is now $3,000 and potential loss is $2,000.

STEP FIVE: REPEAT STEPS 1-4

Practice this over and over! It's only paper money, and you need to make mistakes so you can learn how to do things better.

Tiger says: "You need to make 100-200 trades with 80-90% success to know with confidence that you have really learned something."

Ludwig van Beethoven also chimes in "Don't only practice your art, but force your way into its secrets; art deserves that, for it and knowledge can raise man to the Divine."

Copyright © 2014 - 2016 Honolulu Options Traders, LLC.

All rights reserved worldwide.

LIKE us on facebook.com/honoluluoptionstraders

2. Choosing the