Do you live in a world of . . .

CERTAINTIES <<<< PROBABILITIES >>>> IMPOSSIBILITIES

???

Most people believe in a few certainties. Death will come to everyone, all will pay some taxes, and life will change from year to year. And there are some things we know are impossible, such as making everyone love you or conquering the world in 30 days or less. But the vast majority of our life is lived in the world of  probabilities. In this realm, things are more or less probable, and we make our plans accordingly. Options live in this world.

probabilities. In this realm, things are more or less probable, and we make our plans accordingly. Options live in this world.

Probability is a measure of the likelihood that an event will occur. When I was a kid, we played "two up", a simple coin game in which we tossed a penny to see if it would come up heads or tails. As kids, we were "sure" that if the penny landed heads 2 or 3 times in a row, the next one would be tails! I didn't know anything about probability, so I lost a couple of toys playing that game. Oh, well!

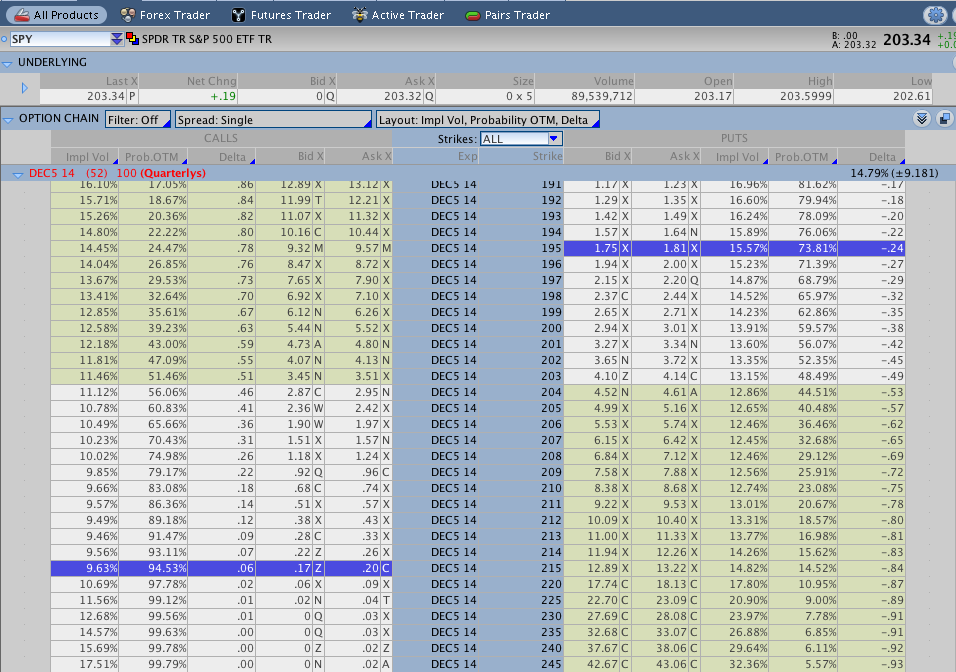

As options traders, we need to be familiar with this world of probabilities. Fortunately, the thinkorswim platform suggests a calculated probability for almost every kind of trade. Under the Trade tab, we find the probabilities listed that any particular Put or Call will expire OTM ("out-of-the-money").

Do you like your chances? Options that are in ITM have a greater chance of expiring ITM and options that are OTM have a greater chance of expiring OTM. Sounds simple, doesn't it? Options currently ATM ("at-the- money") have an approximately 50/50 chance of expiring in the money.

Let's chart it....

Probability of Calls & Puts Expiring Worthless

ITM ATM OTM

Low Medium High

But that does NOT mean, however, that in buying Puts or Calls you will be profitable. Puts and Calls bought ATM have only a 37% chance of being profitable. In fact, about 90% of OTM options expire worthless, or about 70% overall. The reason? Time decay often devalues your option faster than you wish! So you can be ITM ("in-the-money") with a long option at expiration and still lose your shirt. How is this possible?

Example: Let's say you buy an ATM Put or Call for $5. At expiration it might be worth about $1 if the price doesn't change. The stock must move enough to cover any time value built into the premium. If you buy at price X, then your break-even would be X + $5. So buying Puts or Calls ATM is a huge waste of time and money unless you are expecting a big move in the stock price.

Trading an Index Using Calls and Puts

Many traders like to trade the SPY because it mimics the overall market. Here are 2 charts for SPY showing 1) recent price action, and 2) probability of expiring OTM. Each of these charts contains valuable information for SPY traders, as of November 2014.

The first (see left) gives a guide to strategy, as it suggests that SPY is moving up, but that the rate of acceleration is reduced. The small bullish gaps after a recent rapid decline suggests we are in a recovery trend. A trader could cautiously now buy Calls and hope the price trend continues up.

But what kind of risk would the trader be taking on? What is the probability, according to the computer? If I was to buy a Call with an 80% probability of being ITM at expiration, which one should I buy? Or which Put would give me a 50% chance being ITM at expiration? (see next chart).  Probability is not calculated, however, on what we think the stock will do. The future projection is based on past results and current volatility in the market. Computers calculate an option's probability of expiring ITM (or OTM) and offer the percentage, as we see in the screen shot. These percentages are not guarantees, of course, and dramatic moves in the stock will change the outcome significantly. In addition, the probabilities may be skewed just before an earnings announcement, or after a period of high volatility. It is important to review the probability OTM/ITM frequently until you are comfortable with how they work.

Probability is not calculated, however, on what we think the stock will do. The future projection is based on past results and current volatility in the market. Computers calculate an option's probability of expiring ITM (or OTM) and offer the percentage, as we see in the screen shot. These percentages are not guarantees, of course, and dramatic moves in the stock will change the outcome significantly. In addition, the probabilities may be skewed just before an earnings announcement, or after a period of high volatility. It is important to review the probability OTM/ITM frequently until you are comfortable with how they work.

Here are some general rules of probability to follow for beginning traders:

- Probability of ITM plus OTM always equals 100%

- To mimic the action of a stock, choose a Call with 90% chance of expiring ITM, and Delta close to 1.0 (-1.0 for Puts).

- If you expect to SELL an option and collect premium safely, it should have a 80-100% chance of expiring OTM. You really want it to expire OTM, and do NOT want it to expire ITM!

- If you wish to BUY an option because you expect a big price move, either up or down, then choose an option with at least 80% chance of expiring ITM. Also check with the DELTA and make sure it is at least .7 (or -.7 for puts).

- Hedging Puts can be chosen ATM and the number of contracts can be manipulated to form the perfect offset to price decline. For example, if you own 100 shares of stock, then purchase 2 ATM Puts will provide a 1/1 protection if prices decline, but still allow for some profit if prices go up.

Now here's some homework ....

Find the following . . .

1. What is the probability of the Jan 2018 AMZN 1100 Call being ITM at expiration? What is the probability of the Jan AMZN 1100 Put being ITM at expiration? Buy these options together and then place orders to close (sell) at 20% profit for each. (This trade is called a long straddle).

2. Find the sum of the probabilities of the next month AAPL 170 Put and AAPL 180 Call being OTM at expiration. How much will you collect if you sell them together? Sell 2 contracts of each of these two AAPL options, with insurance $5 away for each. How much did you collect? How much margin did that take?

3. Purchase the following positions for this week's expiration:

- +5 SPY Calls @ 75% prob ITM, -5 SPY Calls @ 25% prob ITM

- +1 AZO Call @ 30% prob ITM, +1 AZO Put @ 30% prob ITM, then sell 1 Call and 1 Put two more strikes out

4. Find the cost of the Mar 2018 and July 2018 SPY 260 Puts. Which has the greatest probability of expiring ITM at expiration? Sell them both with $5 insurance, using the vertical tools, and with 5 contracts.

Some quiz questions. . .