Are you a risk taker? Stock options are an excellent way to manage risk. Anyone who owns stocks can now hedge, or insure against loss if the stocks go down in value. Portfolio managers and individual investors use puts and calls to provide protection and add income to their investments. If you own gold or silver or real estate, you can also use options to hedge against market movements. Your brokerage house (TDAmeritrade, OptionsExpress, etc.) mitigates their risk by asking you to put up enough money to cover any potential losses. Notice that YOU put up YOUR money to mitigate THEIR risk. How, then, do traders take care of potential risks? Is there someone they can go to for the money? As traders, we have our own risks to consider. At all times, traders need to be aware of the risk level of their account and positions. You could say that success as a trader depends almost entirely on ability to deal with risk. So here's my anatomy of risk, from the very riskiest types of options trading, to the least risky.

Are you a risk taker? Stock options are an excellent way to manage risk. Anyone who owns stocks can now hedge, or insure against loss if the stocks go down in value. Portfolio managers and individual investors use puts and calls to provide protection and add income to their investments. If you own gold or silver or real estate, you can also use options to hedge against market movements. Your brokerage house (TDAmeritrade, OptionsExpress, etc.) mitigates their risk by asking you to put up enough money to cover any potential losses. Notice that YOU put up YOUR money to mitigate THEIR risk. How, then, do traders take care of potential risks? Is there someone they can go to for the money? As traders, we have our own risks to consider. At all times, traders need to be aware of the risk level of their account and positions. You could say that success as a trader depends almost entirely on ability to deal with risk. So here's my anatomy of risk, from the very riskiest types of options trading, to the least risky.

ANATOMY OF RISK

1. Writing naked Puts and Calls While selling options brings in money, it also exposes the trader to almost unlimited risk and loss. This is the riskiest way to trade options, and the fastest way to lose money. You need a lot of capital write options, so the R.O.I. is questionable. Risk is managed by choosing options far OTM. The further away, and the shorter the expiration, the less the risk.

2. Buying OTM Puts and Calls The most popular way to use options is to simply buy an out-of-the-money Put or Call and hope the stock will move in your favor. You start with something that has zero intrinsic value, and time is always against you. You have to guess how far a stock will move, and if it gets within a inch of your target at expiration, you still lose everything. Risk is reduced by 1) selling whenever profitable, 2)selling another option to help pay for the position. Example: AAPL is at $110 and I think it is going above $120, so I buy a $120 Call for $3.20. Set alert to sell $118 Call at $6.10 and lock in profit. Risk has been reduced to zero.

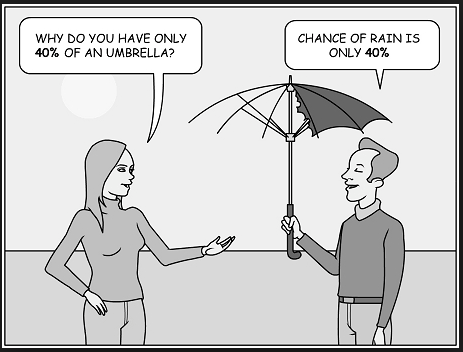

3. Buying ATM Puts or Calls. ATM options have about a 50% chance of being in-the-money at expiration. But time is always against you, as the time value erodes day by day, so in fact, your real probability of profitability is about 38%. Not good odds at all. Risk can be reduced by selling near Puts to pay for the Call, or selling Calls to pay for the Put. However, additional risk is also added by this strategy. See #2 above for additional risk-reduction measure.

4. Buying ITM Puts and Calls These options are composed of some time value, and at expiration are either fully ITM or fully OTM and worthless. Your loss, however, is limited to the cost of the options. Risk is always greatest when the stock changes direction. So the best trade is to buy ITM options with high Delta and sell when you have 20% profit. If you think the stock has further to go, then rinse and repeat! To reduce risk of loss, sell Calls above, or puts below, current price to bring in extra income.

5. Selling OTM Credit spreads Bull Put Spreads and Bear Call Spreads can be either debit or credit trades. However, the credit version has the advantage that time is on your side, as the premiums decay to zero. The spread is formed by selling a near strike and buying a further one. The risk in such cases is precisely "defined". For example, selling a Call spread on IBM at 195/200 brings in $1.40, limiting possible to loss to $3.60. [formula for risk is [difference between strikes] minus credit]. Risk can sometimes be further reduced by adding BPS to BCS, or BCS to BPS, creating an Iron Condor. Close trade whenever profitable.

6. Covered Calls This strategy involves capping a long stock (or synthetic Call) with a short Call. The risk to the stockholder occurs if the total value of the stock--in a worst-case scenario--goes to zero minus the value of the sold call. This would not be much help! The risk associated with a covered call reduces depending on how deep the Call is.

7. Protective Calls If you own stock, you can achieve almost 100% protection on your positions by selling deep-in-the-money Calls. A very deep ITM Call would have a minimum of risk, and is used as a defensive strategy when a stock holder anticipates a significant drop in stock value. Deeper ITM calls provide increased safety for stockholders. Traders reading this anatomy will notice that no strategy is completely risk-free, but this one comes close.

Success sometimes requires a combination of strategies, such as adding a deep-ITM credit spread to an existing bull put spread. In fact, almost any combination of strategies can be used to ensure a minimum of loss. However, the more complicated the trade setup, the higher will be your commissions. Make sure the extra cost is worth the effort in time in money!

One common mistake is filling up your account with long options rather than short, as time will eat away your profits. On average, it is better to sell than buy options, as time is always on your side. Another big risk is in failing to make some proper choices involving risk. Here are some HOT tips to avoid unnecessary risk!

- Do not trade with real money until you have achieved 80% success with your trades over six months or more.

- Don't risk more than 5% of your capital on any trade.

- Try to keep up to 10-20 positions open at any time. There's safety in numbers.

- Buy insurance on your short positions by buying a nearby strike.

- Trade high-probability trades only. Avoid long shots and speculative plays.

- Plan your trades and trade your plan. The greatest risk is not having a plan or method to your trading. « Failing to plan is planning to fail. » – Effie Jones

- Sell rather than buy whenever possible. Keep time on your side and it will double your success rate and profitability.

- You can take risk on and off a trade, so look for opportunities to reduce insurance costs.

- Have someone you respect as a trader look over your trades and account. Nobody becomes a great trader without help.

HOMEWORK

1. Go through the current trades in your account and make your own risk analysis. Arrange them according to risk of loss....from greatest potential loss to least.

2. Risk is not the only factor. Next go through your trades and arrange by probability analysis. Which ones are most likely to be profitable, and which the least?

3. Compare lists 1. and 2. What do you notice? Is it possible to place trades which are both low-risk and high probability?